Value-based obesity care solution Ilant Health adds $2.5M to its seed round

The company initially raised $3 million in seed funding when it launched in October

Read more...

We are hosting our second annual Post Seed (#postseedconf) event on Dec. 1 at Ruby Skye in San Francisco. The event - which we expect to draw more than 500 attendees - kicks off at 8 am and ends around 5 pm. We're excited to have Cory Johnson, anchor at Bloomberg West, broadcasting live from 7 am to 11 am PST. It should be a riveting day! Register here: Post Seed 2015.

As we've noted here for the past couple of weeks or so, the tide has suddenly begin to turn on high valued startups, specifically on unicorns, with investors devaluing their companies and high profile venture capitalists warning that more is coming.

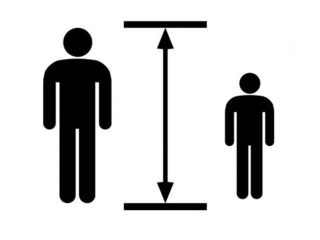

In another sign that the bubble is bursting, or leaking, the percentage of down rounds for companies in stage E or later spiked to 11 percent in the third quarter, up from 7 percent, according to a just-released study by Fenwick & West, titled Silicon Valley Venture Capital Survey Third Quarter 2015.

Up rounds, where companies earned a higher valuation than their previous round, exceeded down rounds, where the companies are valued lower, 86 percent to 4 percent, a wider gap then the previous quarter when it was 83 percent to 9 percent.

In fact, the 82 point difference between up and down rounds was the largest since the firm began calculating up/down rounds in 2002.

So that would indicate that valuations are higher than ever, except for the fact that the median increase in valuations was 51 percent.

That's still an increase, but it's down significantly from 74 percent in the second quarter. It was the slowest growth in valuations since Q3 2014. Internet/digital media companies were hit the hardest; in the first and second quarter they were nearly doubling, with 99 percent and 97 percent. In the third quarter that fell to 83 percent. Software companies also saw the percentage fall from 74 percent to 51 percent.

Interestingly, hardware companies saw their median price rise nicely with 45 percent growth, up from 29 percentage last quarter. I would suspect that the rise in wearables had something to do with that.

Obviously we won't really know how much of an effect recent developments have had on valuations until data for this quarter comes in, but the signs are there that investors are already becoming wary of companies being worth too much.

Fidelity, for example invested in Snapchat's $538 million round this past May, which valued the company at $15 billion, a round that made Snapchat the fourth most valuable private company in the United States, behind Uber, Airbnb and Palantir. Then, earlier this moth firm decided to write down the value of its stake by 25 percent, dropping it from $13.9 billion to $10.4 billion.

The firm also cut the value of its shares in Zenefits by 48 percent, and marked down the value of its share in Dataminr by 35 percent.

The same thing happened to Dropbox earlier this year, when of its investors, BlackRock, cut its estimate of the company’s per-share value by 24 percent.

"I don’t think we will see less of these public markdowns. I think we will see more of them," Fred Wilson, co-founder and Managing Partner of Union Square Ventures, wrote in a blog post on Monday.

"And we VCs are now facing the choice of whether to markdown our portfolios in reaction to Fidelity’s markdowns or explain to our investors and auditors why we did not do that."

It's probably a good bet to say that the next time these numbers come in, we are going to see a big drop in company valuations.

(Image source: theretirementpros.com)

The company initially raised $3 million in seed funding when it launched in October

Read more...This is the company's first fundraising since 2019 and brings its total capital to $103M

Read more...ROOK lets health, fitness, and wellness companies take data from devices and make it actionable

Read more...