DrFirst buys prior authorization automation platform Myndshft

This will allow DrFirst to accelerate its growth in the specialty medication space

Read more...

With Business Insider being purchased by German publishing giant Axel Springer on Tuesday, a move that follows a series of high profile investments in BuzzFeed and Vox from NBC Universal earlier this year, it can't help but beg the question: has new media officially taken over?

The answer to that question, at least according to data out from CB Insights, seems to be a resounding yes. I mean, it was already kind of obvious, but now we just have the numbers to prove it.

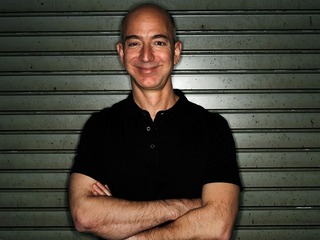

It becomes especially clear when you consider this: the deal to buy Business Insider came at a price of $343 million, valuing the company at $442 million; that price is 77% more than the $250 million that was paid by Amazon’s Jeff Bezos when he bought the The Washington Post in 2013.

In fact, there are a slew of digital news and media companies that, either through acquisition or funding raising, are now worth more than their old media counterparts.

The two best known are the two companies that raised big rounds from NBCUniversal, for which investing in new media companies seems like part of its ongoing strategy to stay relevant in a rapidly shifting landscape. First the company put $200 million into digital media company Vox Media, which was followed by a $200 million funding round in BuzzFeed a week later.

Those investments turned both companies in unicorns; Vox is now worth $1 billion, which BuzzFeed is worth $1.5 billion. The most valuable company in this space is Vice, which is worth $2.5 billion.

There are other, less-well known media companies that havs been acquired. That includes SNL Financial, which was bought by McGraw-Hillfor $2.23 billion, and Mergermarket which was bought by BC Partners from Pearson for $624 million in 2013.

Other startups in the digital news and media realm valued at $100 million or more include Refinery29, which has a $250 million valuation, and Ozy Media, which is valued at $120 million.

Now let's compare those to the FT, which is worth $1.3 billion; The Economist, which is worth $1.4 billion; the Boston Globe, which is worth $70 million; and Forbes, which is worth $475 million.

So four of the six media companies that are worth over $1 billion are digital companies, as are nine of the 14 companies worth at least $70 million.

That doesn't mean that old media is going away completely. Or that old media companies cannot transform themselves into new media by pushing their content online.

Some will have a hand in both new and old media. Take Axel Springer, for example.

The Axel Springer company is the largest publishing house in Europe and controls the largest share of the German market for daily newspapers. Its publications include Die Welt, Bild (which is the newspaper with the largest circulation in Europe), Auto Bild (an automobile magazine with the largest circulation in Europe), and the German edition of Rolling Stone magazine, among numerous others.

The company, which backed both Business Insider and Ozy Media, also tried to buy the Financial Times from Pearson this summer, before losing its bid to Japan's Nikkei, who bought it for $1.3 billion.

(Image source: danishfashionethicalcharter.com)

This will allow DrFirst to accelerate its growth in the specialty medication space

Read more...The company initially raised $3 million in seed funding when it launched in October

Read more...This is the company's first fundraising since 2019 and brings its total capital to $103M

Read more...Startup/Business

Joined Vator on

CB Insights is a private company database that provides real-time information on the world's most promising companies, their investors, their acquirers and the industries they compete in to help you invest smarter.

Since launching in 2010, CB Insights has become the most trusted and loved source for private company information. Hundreds of clients (including New Enterprise Associates, Cisco, Salesforce, Castrol and Comcast) rely on CB Insights to help them answer the tough questions.

If you like data, startups or quality analysis, join the other 110,000+ subscribers of our free newsletter.

We received a grant from the National Science Foundation in 2010 and Series A investment from RSTP in 2015.

We're hiring! Want to join a fast-moving, fun-loving group of data lovers? Head over to our jobs page.

Startup/Business

Joined Vator on

Find Buzz: We show you what’s buzzing on the web. Our technology, human editors, and trend spotters help you find your new favorite thing. Get fresh buzz daily on BuzzFeed.com, via RSS, and from our extended network.

Create Buzz: BuzzFeed’s publishing tools and trend detection empower a select group of trend-spotters and buzz-makers. Our new publishing tools are currently in a limited beta. Let us know if you want to know more or are interested in participating.

1. Find Good Things

We use technology and human editors to find the hottest buzz on the web. Each weekday, we publish ten stories that highlight the best stuff emerging from the Internet popularity contest. Find your new favorite thing on BuzzFeed.com, via RSS, and from our extended network.

2. Promote Great Sites

We strive to send as many clicks as possible to the bloggers, journalists, and fans who are creating buzz, driving the conversation, and making the web exciting. And we pay special attention to the quality sites who join our network by displaying the BuzzFeed widget. Are you a blogger or publisher? Join our network now!

3. Web-ify Advertising and PR

We developed a new form of PR and Advertising designed for the new networked world where consumers have the power. Instead of press releases and canned ad copy, we work with partners to amplify the voice of the most interesting bloggers, fans, journalists, and buzz makers. Inquire about BuzzFeed PR and Advertising Services.