UnitedHealth Group makes $10M investment in Appalachian community health

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...

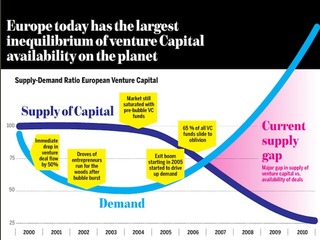

Accelerators and incubators have exploded around the globe, making Series A investments a more highly-sought after round. So when a new Series A fund emerges, it's welcome news, particularly in parts of Europe that don't have many institutional VCs to keep the plethora of newly-minted startups going.

Earlybird Venture Capital announced the closing of its newest early-stage fund. It's called Earlybird's Digital East Fund, which for the first time in its 17-year history will be targeting Turkey and Central and Eastern Europe.

The fund is some $110 million, with a target of $130 million. More than half of the funds will be used for follow-on capital.

The fund is Earlybird's fifth since inception in 1997, bringing Earlybird's total capital raised to date to more than $900 million. Prior to this fund, Earlybird had been focusing mainly on Germany, Switzerland and Austria. This will be the first time it will look only in Turkey and Central and Eastern European countries, such as Romania and Bulgaria.

"About two years ago, we decided to expand our business," said Roland Manger, co-founder of Earlybird Venture Capital, who is leading the investments of the Digital East Fund. "The world has changed and one of the things that has changed [for venture capital and for us] is becoming an international team... We wanted to look East of Berlin and go after largely untapped VC markets... There are few to no institutional VCs in Eastern Europe."

To enter the market, Earlybird joined forces with two angel investors with entrepreneurial backgrounds, Cem Sertoglu and Evren Ucok, considered two of Turkey's most active angels. Also on board is Dan Lupu, who has invested for Intel Capital in Eastern Europe. The combined team has had a track record of success, with investments in Peak Games (a top 5 mobile social gaming company), and Trendyol.com (a fashion e-commerce company based in Turkey).

Given Earlybird's longstanding track record, it managed to raise about 45% of its funds from existing investors.

So what is Earlybird's sweet spot? "We're doing selective seed," said Manger. "[But] our main focus is early-stage and early-growth. If you look at these regions, they're basically untapped in terms of institutional capital, but you have vibrant seed funds (partially government funded). There's also quite a number of business angels." To that end, Earlybird is coming in to fill a void: institutional capital at the early stages, beyond seed.

Earlybird will invest about $1 million to $3 million. The valuations are a lot lower than the US, said Manger, with Series A rounds coming in at $1 million to $4 million, valuations typically assigned to seed-stage companies in the US. Manger expects between 20% to 30% of its portfolio companies will get follow-on capital.

As for sectors, Earlybird plans on looking at broad tech, including the Internet of Things, as well as video and security technologies.

Image source: Shesoverseas.com

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.

All author postsInvest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...The firm, which now has over $4 billion in assets under management, invests across all stages

Read more...Founded by Ignition's Kellan Carter and Cameron Borumand, Fuse will invest in B2B software companies

Read more...