Using generative AI for health plan claims, Alaffia Health raises $10M

Amish Jani, Founder and Partner at FirstMark, joined the company's Board of Directors

Read more...

Facebook is set to report its fourth-quarter earnings after the close Wednesday. The report will be its third as a publicly-traded company. Wall Street expects the social network to earn 15 cents a share on revenue that is expected to grow 25% to $1.52 billion.

Investors will not only look for Facebook to beat these estimates, but they'll be looking closely at how Facebook's mobile, advertising and commerce revenue comes in. They'll also be looking for the company to share insights on the kind of revenue it can derive from Graph Search.

Mobile usage

Facebook users have been seeing more users become more active on their mobile devices.

In its last earnings report, mobile monthly active users were 604 million at the end of September, up 61% year-to-year, and up 11% from 543 million MAUs in the second quarter, an increase of 67% from the same quarter in 2011.

In a conference call after the third quarter, Mark Zuckerberg called mobile, "the most misunderstood aspect of Facebook today” and said that people were underestimating how good the trend toward mobile can be for the social network.

He outlined three reasons for this: mobile allows Facebook to reach more people than desktop, people on mobile use Facebook more often, and, in the long-term, Facebook will be able to monetize better for the amount spent on mobile than on desktop.

Tomorrow, investors will clearly be looking to see whether mobile usage continues to rise, but also whether the growth rate of active users also continues to slow down.

Mobile Advertising

Facebook's advertising revenue will make or break the company.

Advertising revenue was $1.09 billion, up 36% from the same period a year ago. This is much higher than the 28% growth rate in the second quarter when advertising revenue hit $992 million, which was well above analysts' expectations. Clearly advertising revenue has been on an upswing. At the last quarter, it accounted for 86% of total sales.

Data released by digital marketing software Kenshoo earlier this month showed that mobile ad spending is growing quickly.

Kenshoo found that that 20% of Facebook ad spending is put into ads that are delivered exclusively on mobile and that Facebook mobile ads are currently priced at a 70% premium over desktop ads, costing $1.38 a click, compared to 81 cents on desktop.

During the same conference call in October, Mark Zuckerberg said that mobile accountied for 14% of ad spending, meaning it has gone up 6% in just four months.

Zuckerberg called it a "myth" that Facebook cannot make money on mobile. They simply had not started trying yet. he said and, after just six months since ramping up mobile ad revenue, the social network was already seeing 14% of its ad revenue, or $150 million, coming from mobile. Investors will be looking to see how that percentage has grown since October.

In August of 2012, Facebook introduced mobile ads for apps, which allowed app developers to advertise on News Feeds on Facebook’s mobile app, in August. The ads were so successful that, in December, eMarketer updated its projected ad spending growth for 2012 based almost exclusively on Facebook mobile ads.

Other sources of revenue

Beginning last year, Facebook has been experimenting with other forms of revenue.

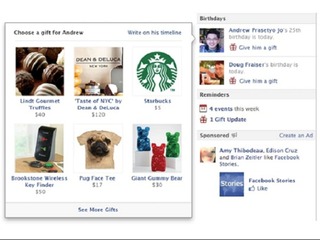

This has included e-commerce, which Facebook entered into by launching a revamped Gifts feature in late September that allowed users to send each other real gifts by mail. The social network ramped up the service for the holidays, adding new partners and digital subscriptions. Investors may be looking to see how well Facebook has been able to monetize the product so far to gauge its future potential.

Then, of course, the newest product, Graph Search, which was launched earlier this month. The product is still in beta, but investors will be looking to hear how Facebook eventually plans to monenetize the product going forward.

Doug Anmuth, analyst at JP Morgan Chase, wrote in a note after the launch that he believes, eventually it will be able to compete with Goole, Yelp and TripAdvisor. But he also said that he doesn't believe that Graph Search will open up revenue opportunities in the short run.

"Graph Search may not have the near-term revenue impact of some other initiatives that the Street was looking for in Tuesday’s announcement, but we think it makes Facebook’s data far more useful by giving it greater shelf life and surface-ability, which should deepen engagement on the site. Increased monetization is likely to follow. We reiterate our Overweight rating on Facebook shares."

Upward trajectory

Based on the dramatic turnaround of Facebook's shares since mid-November (when shares were trading under $20), investors may be optimistic that Facebook will release a solid report.

After all, it did so the last time it reported. For Facebook's third quarter, it earned 12 cents a share, a penny above expectations, and generated revenue of $1.262 billion for the quarter, beating Wall Street's estimates of $1.23 billion.

But the stock may have run a bit ahead of itself in the last couple weeks. Facebook's shares ended down 5.17% to $30.79 in Tuesday trading.

Facebook's shares have been trading around $30 ever since closing above that price on January 9, for the first time since July 16, when it hit a high of $30.50. The last time the stock had closed above that range was July 13, when it closed at $30.72 a share.

One factor behind Facebook's stock rebound was the completetion of major lockups. The last day that Facebook ended trading below $20 was November 13. The next day, Facebook saw its biggest lockout end, with 800 million shares of employee stock becoming available for trading.

(Image source: https://westlawinsider.com)

Amish Jani, Founder and Partner at FirstMark, joined the company's Board of Directors

Read more...The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...Service provider

Joined Vator on

Founded in 2006 by software engineers and search marketers, Kenshoo is a global innovator in search engine marketing technology with extensive industry knowledge. Kenshoo's flagship product, KENSHOO SEARCH™, is an end-to-end Search Engine Management platform, which automates the process of building and optimizing cross channel search campaigns. The platform offers advanced features such as bid management, tracking, a unified dashboard and many more.

Kenshoo understands online retail and has several clients in the top 500 of Online Retailers. We work hard to integrate inventory and consumer websites with the Kenshoo platform to enable retailers to build automated highly relevant online advertising campaigns.

KENSHOO SEARCH was built on Kenshoo’s unique Quality Management™ methodology. Quality Management is a holistic approach to search marketing that automates most of the labor intensive search marketing operations and gives search markets a wide array of features in a natural workflow for greatest ease of use.