UnitedHealth Group makes $10M investment in Appalachian community health

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...

Who says venture capital is slowing down? Yesterday it was revealed that Sequoia Capital was looking to raise a new fund, mere months after raising $1 billion and they were not the only ones: venture capital firm Morgenthaler Ventures is looking to raise a new fund, according to sources close to the fund.

The fund, which would be Morgenthaler’s tenth, will be called IT Fund X and it will be focused on early stage IT companies. Morgenthaler has capped the fund at $200 million.

No formal documents have been distributed, but the firm is already having conversations and should begin its fundraising efforts in January.

Menlo Park, California-based Morgenthaler Ventures was established in 1968, and has invested in numerous companies in its forty-plus year history, including NexTag, Siri, Jaspersoft, MuleSource, Practice Fusion, Force10, Sezmi, Nominum, Voltage Security, Peregrine Semiconductor, Cortina, Brion, Synopsys, Verifone, Nuance Communications, Apple and NEXTEL.

Morgenthaler previously raised $400 million for its ninth fund in 2008, using the money to invest in both IT and life sciences. For the IT portion of the fund of Fund IX is generating a net IRR (internal rate of return) of roughly 70% through Q3 2012, a limited partner told us.

Morgenthaler raised its ninth fund in 2008, a $400 million effort that was evenly split between between IT and life sciences. Morgenthaler used the money it raised to participated in a $20 million round, and then a $50 million round, of financing for organization tool Evernote. The firm also participated in a $25 million round for Lending Club, a platform where users can take out personal loans or invest in them. Morgenthaler also led a $15 million round for Pageonce, a mobile finance app.

In September, the firm led a $17 million Series B round of funding for Doximity, which helps doctors get the help they need via a HIPAA-compliant social network just for physicians.

The new fund will reportedly have nothing to do with Lightstone Ventures, which is a firm that was formed by the life sciences partners at Morgenthaler Ventures and Advanced Technology Ventures. Lightstone is raising a separate $250 million fund, which will focus on early-stage therapeutics and medical devices.

Morgenthaler Ventures would not comment.

A list of 2012 funds

Kleiner Perkins Caufield & Byers closed a $525 million fund In May. In April, early-stage venture capital firm First Round Capital announced that it was going to raise its fourth fund, with a target of $135 million, while Berlin-based Earlybird raised a $100 million fund. In March, Groupon investor NEA filed with the SEC to raise $2.3 billion, while DST, one of Facebook's biggest investors, was looking to raise $1 billion.

Andreessen Horowitz secured a $1.5 billion fund in January, announcing it had raised $2.7 billion in three years. While it has only been around since 2009, Andreessen Horowitz is already a top VC firm, raking in siginificant management fees.

In June, Khosla Ventures announced a new fund for an undisclosed amount, while Madrona Venture Group closed a $300 million fund.

In August, Sequoia Capital surpassed its goal of raising $975 million for three early-stage funds, and just yesterday Nexus Venture Partners, a venture firm whose major focus is on India-based technology startups, announced Thursday that it's raised $270 million for its third fund.

Thrive Capital closed a $150 million fund in September, and in October Trinity Ventures began targeting a $325 million fund.

In October, Atomico Ventures raised a $286 million fund, and NTT Docomo, the largest phone operator in Japan, announced a new ¥10 billion, or $125 million, fund, meant to help new businesses develop for smartphones and tablets

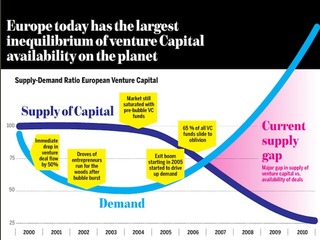

There were 53 U.S. venture capital funds in the third quarter of 2012, which raised around $5.0 billion. Despite the larger number of deals, there was a 17% decrease by dollar commitments compared to the second quarter of 2012, which saw 43 funds raise nearly $6.0 billion.

(Image source: https://www.morgenthaler.com/)

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...The firm, which now has over $4 billion in assets under management, invests across all stages

Read more...Founded by Ignition's Kellan Carter and Cameron Borumand, Fuse will invest in B2B software companies

Read more...Startup/Business

Joined Vator on

Siri is a Virtual Personal Assistant - a new way to interact with the Internet on your mobile phone. Like a real assistant, Siri helps you get things done. You interact with Siri by just saying, in your own words, what you want to do. You can ask Siri to find a romantic place for dinner, and get reservations for Saturday night. You can discover things to do over the weekend, get tickets to the movies, or call a cab when you’re out on the town. You don't have to search through a bunch of web pages, following links and hunting down facts. Siri does all the work giving you the information you need at your fingertips.

We believe that in five years most people who use the Internet will have a Virtual Personal Assistant (VPA) to take care of the details of using online services. We will look back at the birth of VPAs in 2009 and wonder how we ever got by without our trusted assistant. The days of wading through links and pages from your mobile interface will seem quaint, because the natural way to interact with the rich world of information and services is to have a conversation. As John Batelle, the author of The Search, says "The future of search is a conversation with someone we trust."

Startup/Business

Joined Vator on

Morgenthaler Ventures has been dedicated to helping entrepreneurs build valuable companies for more than 42 years. Today, the firm has nearly $3 billion under management, including $400 million in its ninth fund, capitalized in November of 2008. Morgenthaler has invested in approximately 300 companies in the information technology and life science sectors. Representative portfolio companies in the IT space include: NexTag, Siri Inc., Evernote, Lending Club, Jaspersoft, MuleSource, Practice Fusion, Force10, Sezmi, Nominum, Voltage Security, Peregrine Semiconductor, Cortina, Brion, Synopsys, Verifone, Nuance Communications, Apple and NEXTEL.

Startup/Business

Joined Vator on

Pageonce is the first mobile company that allows users to access, view and manage all of their personal online accounts in a single secure application. Pageonce provides anytime, anywhere account access via iPhone and BlackBerry. With access to thousands of providers across banking, finance, credit cards, investments, utilities, airlines, hotels, ecommerce sites and more, users enjoy access to detailed transaction history and account activity and receive alerts when key changes occur in any of their accounts.

Startup/Business

Joined Vator on

NexTag is the leading comparison shopping site for products, financial services, travel, automobiles, real estate, education and more. At the core of NexTag are proprietary technologies and algorithms that enable shoppers to quickly compare prices and find the best deals on millions of products and services. For thousands of merchants, service providers and individuals, NexTag is an extremely efficient sales channel with its highly qualified traffic and performance-based pricing. More than 17 million people per month use NexTag to research, compare, and save on products and services online.

NexTag has been named among the nation's fastest growing companies by Inc. 500, Deloitte Technology Fast 500/Fast 50, Red Herring Top 100, San Francisco Business Times Fast 100, and the Silicon Valley/San Jose Business Journal Fast 50. The company operates comparison shopping sites in the US (www.nextag.com), the UK (www.nextag.co.uk), France (www.nextag.fr), and Germany (www.nextag.de). NexTag is headquartered in San Mateo, California with offices in London and Gurgaon, India.

Startup/Business

Joined Vator on

Lending Club is a social lending network where members can borrow and lend money among themselves at better rates.

Lending Club provides a much improved infrastructure for social lending: state-of-the-art technology to authenticate all users (ensuring making sure they are who they say they are); credit scoring systems which rate borrower risk; and, the automated clearing house (ACH) system to move the funds between both parties. In addition, we provide our LendingMatch™ system to minimize risk and allow community based lending.

Startup/Business

Joined Vator on

Our goal at Evernote is to give everyone the ability to easily capture any moment, idea, inspiration, or experience whenever they want using whichever device or platform they find most convenient, and then to make all of that information easy to find.

And we’ve done just that. From creating text and ink notes, to snapshots of whiteboards and wine labels, to clips of webpages, Evernote users can capture anything from their real and digital lives and find it all anytime.

Evernote is an independent, privately held company headquartered in Mountain View, California. Major investors include Sequoia Capital, Morgenthaler Ventures, Troika Dialog, and DOCOMO Capital.

Startup/Business

Joined Vator on

Practice Fusion provides a free, web-based EMR system to physicians. With medical charting, scheduling, e-prescribing (eRx), lab integrations, referral letters, Meaningful Use certification, unlimited support and a Personal Health Record for patients, Practice Fusion's EMR the complex needs of today's healthcare providers and disrupts the health IT status quo. Practice Fusion is the fastest growing Electronic Medical Record community in the country with more than 150,000 users serving 40 million patients. The company closed a $23 million Series B round of financing led by Founders Fund in 2011. For more information about Practice Fusion, please visit www.practicefusion.com

Angel group/VC

Joined Vator on

We are entrepreneurs with a global perspective who invest in passionate entrepreneurs with disruptive, powerful ideas.