Using generative AI for health plan claims, Alaffia Health raises $10M

Amish Jani, Founder and Partner at FirstMark, joined the company's Board of Directors

Read more...

It has been a long, winding road for Facebook’s stock since it debuted in May. Things are beginning to look a little brighter, though, and the stock may yet be able to rebound.

The social network giant’s stock closed Friday at $22, up 6.21%. That is the highest the stock has closed in six weeks, when it hit $23.03 on July 30th.

The stock has rebounded since the stock cratered following the end of the company’s first lockup in August. The stock hit an all time low on September 4th, ending at $17.73. It is still down 42% from its $38 IPO price, though, and there is still a lot of work to be done to get it back to where investors want it to be.

So what has made the difference the last week and a half to get the stock back up to a more reasonable price?

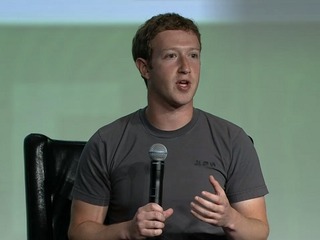

First, there was CEO Mark Zuckerberg’s declaration on September 5th that he would not sell his stock for at least a year. Zuckerberg holds roughly 444 million shares of Class B common stock as well as 60 million shares of Class B common stock issuable upon the exercise of an option. At the same time, two Facebook directors, Marc Andreessen and Donald Graham, announced that would be selling off some personal stock to pay their RSU tax bill, but that they will not be selling off any shares beyond that.

The intention of Zuckerberg, as well as the two directors, to hold on to their stock immediately appeased some of the company’s underwriters, as it pointed to executives at Facebook having confidence in the company. The news in the filing may have also helped to reassure investors.

Then, on September 11, Zuckerberg gave his first public interview since the IPO back in May, in which he said that Facebook is now a mobile company, and in which he elaborated on how Facebook would tackle advertising on the platform.

Mobile has long been an issue with Facebook. So much so that, in a pre-IPO document filed with the SEC in May, said that it does "not currently directly generate any meaningful revenue from the use of Facebook mobile products, and our ability to do so successfully is unproven."

The reason that such a statement would be such a cause of concern is that according to a filing with the SEC in July, Facebook saw its mobile monthly active users (MAUs) increase by 67% in the course of one year, from June 30, 2011 to June 30, 2012.

In June of this year alone, 102 million Facebook users accessed the site exclusively through the mobile app or mobile website, a 23% increased from the 83 million who did the same during March.

Facebook, however, has since come up with a few ways to deal with its mobile advertising problem, first debuting new mobile ads for apps, which will allow app developers to advertise on News Feeds on Facebook’s mobile app.

During his interview, Zuckerberg said that mobile is a lot closer to television than desktop is, just in terms of how the ads must be integrated.

On desktops, Facebook has the ads that appear on the right hand column. "It’s been great," he said. "We built a multi-billion dollar business by doing that.”

On mobile, though, Facebook can’t structure its ads the same way, simply because there isn’t room on the screen, so the ads have to be more integrated.

The ads appear in user News Feeds as what looks like suggestions, or recommendations, for which apps a user may like. For example, it may come under the header "try these games." Once a user clicks on one of the ads, or suggested apps, they will be redirected to either the iOS App Store or to Google Play to purchase that app.

According to Zuckerberg, these ads are already performing better than the right hand column ads.

Then, earlier this week, Facebook Exchange, which was first launched back in June, came out of beta stage.

Facebook Exchange allows marketers to use real-time customer data to reach a larger audience on Facebook. Essentially, if a person visits a website, but does not buy anything, that business can retarget those people the next time they go on Facebook.

“Facebook represents a large portion of display ad inventory on the web—more than 25% according to a recent ComScore study—so this is a significant opportunity for advertisers using DSPs to extend the same strategies that are working for them on other display exchanges to Facebook,” says Scott Shapiro, product marketing manager for Facebook Exchange.

Since debuting in June, Facebook Exchange has already been very successful, according to multiple companies who use it, including AdRoll, TellApart and Triggit.

According to AdRoll, its 60 advertisers who launched campaigns on Facebook Exchange, including Room & Board, HootSuite and GoPro, are already seeing a 16 times rate of return on their investments, while TellApart says that its clients have seen a 10 to 20 times return on investment. Users who were shown ads on Facebook Exchange, were as likely, or more likely, to click through than other ad exchanges. Facebook Exchange has an average click through rate of 6.6%.

Triggit writes that Facebook Exchange has seen return on assets that are four times higher than traditional ad exchanges. It also has a post-click conversion rate that was 2.2 times higher, and a cost per click-through order that was 6.5 times less.

(Image source: pandithnews.com)

Amish Jani, Founder and Partner at FirstMark, joined the company's Board of Directors

Read more...The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...