Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

Read more...

There has been a lot written about unicorns lately, including by yours truly, and for good reason. The rise is $1 billion valuation companies could be a good indication of a potential bubble brewing in the private market.

There's another trend that is starting to take shape, though, and it could be even more troubling: the $1 billion funding round.

The first time I saw a round of that size was in Uber in June of 2014. It seemed extraordinary at the time... until Uber did it again in December. Then again in January. And multiple times since, with the latest coming in September of this year.

In all there have been only 11 companies, and only 16 of these types of rounds, since 2010, according to a report from CB Insights. The most amazing thing: all but two of them came in 2014 or 2015.

The only two companies to raise such huge rounds prior to 2014 were JD.com and Facebook.

JD.com raised its $1.5 billion round in 2011, from Digital Sky Technologies, Tiger Fund and Walmart, while Facebook. which raised its own $1.5 billion funding round the same year, also from Digital Sky Technologies, as well as Goldman Sachs. That valued the company at $50 billion.

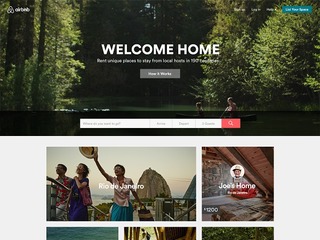

More importantly, that remained a record for a U.S. company until, of course, this year, when it was tied by Airbnb, which raised its $1.5 billion round in June, valuing it at $25.5 billion. It may be easier to get that money now, but it certainly doesn't seem to go as far as it used to.

There are a few things of note. First, most companies on this list have only raised a single $1 billion round. There are only two who have raised multiple rounds, and they both come from this sector.

The first is, of course, Uber, which has done it a whopping six times, Yes, Uber has six rounds of at least $1 billion.

The first two came in 2014, first raising a $1.2 billion back June, followed by another $1.2 billion funding roundin December.

That was followed by four such rounds in 2015, starting with $1.6 billion in a convertible debt round in January, another $1 billion in February, $1 billion in June and, finally, $1.2 billion in August.

In case you stopped counting, that is a total of $7.2 billion in the last year and a half. It is now the most valuable company in the world at $50 billion.

The only other company to have more than one $1 billion round is Uber's biggest rival in China, Didi Kuaidi, which first raised a $2 billion round of funding n July, followed by another $1 billion last month. It is now valued at $16.5 billion.

That gets to the other interesting thing about this list: half of them are companies that operate outside of the U.S.

In addition to the companies I already mentioned, the only other two that are based in the United States are SpaceX, which raised $1 billion, at a $12 billion valuation, from Fidelity Investments and Google in January, and Social Finance, the most recent company to join this list, having raised $1 billion at a $4 billion valuation just last week.

With Uber, Airbnb, SpaceX, SoFi, and Facebook, that is only five of the 10 companies. All the others are international, including South Korean company Coupang, which raised $1 billion round, at a $5 billion valuation in June; Chinese company Xiaomi, which raised $1 billion in December of last year, at a $46 billion valuation; and Indian company Flipkart, which raised $1 billion in July of 2014, to be valuaed at $15 billion.

These huge rounds, even more than ballooning valuations, could be the ultimate sign that things are getting out of control.

(Image source: memecrunch.com)

The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...The country will need an additional 203,200 RNs each year until 2031 to fill staffing shortages

Read more...