Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

Read more...

It's election season so you know what that means: a lot of talk about small businesses, and how they are the "backbone of our economy," or something like that. What you won't hear that much about, though, as specific solutions on how to help them. Because rhetoric is easier than action.

One company that is looking to actually benefit small businesses is Fundbox, a lending startup that offers SMBs a solution to getting working capital on the quick.

The idea has certainly caught the eye of venture capitalists, as the company has been raising money at a fast clip recently.

On Thursday it announced a new $50 million funding round, led by new investor Spark Capital Growth with participation from Bezos Expeditions (the personal investment arm of Jeff Bezos), Ashton Kutcherand Guy Oseary's Sound Ventures, Entrée Capital and existing investors: Khosla Ventures, General Catalyst Partners, Shlomo Kramer, and Blumberg Capital.

This new funding comes less than six months after the company closed a $40 million Series B funding round in March. It's total capital raised now stands at $107.5 million.

"We are thrilled to bring on Spark Capital Growth as they understand the mindset of a hyper-growth startup, as well as the Fintech space. Spark will provide invaluable expertise as we work to realize our mission of being the go-to cash flow solution for small business, and continue building the world's first B2B credit network," Eyal Shinar, chief executive officer at Fundbox. said in a statement,

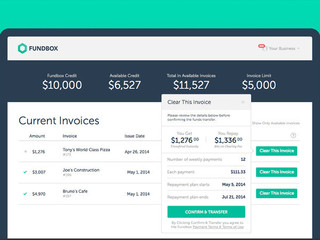

Founded in 2012, the San Francisco-based Fundbox works exclusively with small-to medium-sized B2B businesses by allowing them to create an account, connect their unpaid invoices, select which ones to clear, and get an advance for the amount transferred to their bank account instantly.

The company's algorithms leverage data science, behavioral analysis, and finance theory to assess the risk. Because the automatic analysis doesn’t add any additional costs on Fundbox’s end, there is no minimum limit to how much a business can borrow.

Without specifying exact fees, the company does say they’re comparable or lower than credit card APR rates. And fees become cheaper the more a business uses Fundbox.

Customers can repay the loan in 12 weekly installments starting immediately, and there are no penalties for early payments. If a loan is repaid early, finance fees are refunded.

On top of the funding, Fundbox also announced some new growth numbers. It now underwritten its 15 millionth invoice while also completing its seventh consecutive quarter of at least 2x quarter-over-quarter revenue growth.

The company says that it is mow on track to double its revenue growth every 75 days.

VatorNews has reached out to Fundbox for further comment on its future plans. We will update this story if we learn more.

(Image source: fundbox.com)

The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...The country will need an additional 203,200 RNs each year until 2031 to fill staffing shortages

Read more...