Funding roundup - week ending 6/20/15

Doctor On Demand, Softbank, Namely, Mezaaj, Are You A Human, Framebridge, Spacious, MentAd, GoFundMe

Read more...Seed stage

![]() Fliptu raised $1.2 million in seed funding from investors that included Scout Ventures, Rick Dalzell, Rich Heise, Hivers & Strivers, Kelly Perdew, and other angels.

Fliptu raised $1.2 million in seed funding from investors that included Scout Ventures, Rick Dalzell, Rich Heise, Hivers & Strivers, Kelly Perdew, and other angels.

![]() RefME, a book-barcode scanning app automate citations, reference lists and bibliographies, raised a $5 million seed funding round led by GEMS Global and angel investors.

RefME, a book-barcode scanning app automate citations, reference lists and bibliographies, raised a $5 million seed funding round led by GEMS Global and angel investors.

![]() Conversion Logic, a provider of analytics for video ads, raised $4 million in a seed round led by Rincon Venture Partners, along with Crosscut Ventures, Lerer Hippeau Ventures, TenOneTen, Founder Collective and Raptor Ventures.

Conversion Logic, a provider of analytics for video ads, raised $4 million in a seed round led by Rincon Venture Partners, along with Crosscut Ventures, Lerer Hippeau Ventures, TenOneTen, Founder Collective and Raptor Ventures.

![]() Wear VR, an app store for virtual-reality games, raised a $1.5 million funding round from undisclosed investors.

Wear VR, an app store for virtual-reality games, raised a $1.5 million funding round from undisclosed investors.

![]() Folloze, a prospect engagement platform for B2B sales and marketing, raised $3.3 million in seed funding led by NEA, Cervin Ventures and TriplePoint Ventures with participation from angel investors.

Folloze, a prospect engagement platform for B2B sales and marketing, raised $3.3 million in seed funding led by NEA, Cervin Ventures and TriplePoint Ventures with participation from angel investors.

![]() Haystack TV, a customized news aggregator, raised $1.7 million in seed funding from investors that included Peter Kellner, Inspovation Ventures, DeltaG Ventures, Larry Braitman, David Anderman, SGH Capital, and StartX Fund.

Haystack TV, a customized news aggregator, raised $1.7 million in seed funding from investors that included Peter Kellner, Inspovation Ventures, DeltaG Ventures, Larry Braitman, David Anderman, SGH Capital, and StartX Fund.

![]() Cloud security startup Praesidio raised $1.7 million in seed funding from undisclosed angel investors.

Cloud security startup Praesidio raised $1.7 million in seed funding from undisclosed angel investors.

![]() Showbie, provider of a paperless classroom, raised a total of $2.3 million in seed funding from Point Nine Capital, Kymbask Investments, Yaletown Venture Partners and Imagine K12.

Showbie, provider of a paperless classroom, raised a total of $2.3 million in seed funding from Point Nine Capital, Kymbask Investments, Yaletown Venture Partners and Imagine K12.

![]() Slidejoy, a lock screen advertising company, raised $1.2 million in a round led by members of the Wharton Angel Network and Harvard Business School Angels.

Slidejoy, a lock screen advertising company, raised $1.2 million in a round led by members of the Wharton Angel Network and Harvard Business School Angels.

![]() Amberjack, a site for booking fishing trips, raised $500,000 in a seed round led by BoxGroup, with participation from Slow Ventures, Prehype, Scott Belsky, Jay Livingston and Josh Abramson.

Amberjack, a site for booking fishing trips, raised $500,000 in a seed round led by BoxGroup, with participation from Slow Ventures, Prehype, Scott Belsky, Jay Livingston and Josh Abramson.

![]() Fan-driven, sports sharing platform ScoreStream raised a $2 million Seed rund led by Sinclair Digital Ventures.

Fan-driven, sports sharing platform ScoreStream raised a $2 million Seed rund led by Sinclair Digital Ventures.

![]() 24i Media, a TV app software company, raised $2 million in a found round from Newion Investments.

24i Media, a TV app software company, raised $2 million in a found round from Newion Investments.

![]() DemoChimp, a Software as a Service company, raised $2.8 million in a seed funding round led by Peak Ventures, along with Albion Financial, Seed Equity, Select Venture Partners, Paul Ahlstrom, Scott Frazier and Greg Schenk.

DemoChimp, a Software as a Service company, raised $2.8 million in a seed funding round led by Peak Ventures, along with Albion Financial, Seed Equity, Select Venture Partners, Paul Ahlstrom, Scott Frazier and Greg Schenk.

![]() Blisby, an online marketplace, raised $300,000 in a funding round led by East Ventures and DeNA, along with 500 Startups

Blisby, an online marketplace, raised $300,000 in a funding round led by East Ventures and DeNA, along with 500 Startups

![]() PeerIQ, a financial information services company, raised $6 million in a seed round led by Uprising and John Mack, along with Vikram Pandit, Arthur Levitt, Dan Doctoroff and Eric Schwartz.

PeerIQ, a financial information services company, raised $6 million in a seed round led by Uprising and John Mack, along with Vikram Pandit, Arthur Levitt, Dan Doctoroff and Eric Schwartz.

![]() Vidme, a video sharing application, raised $3.2 million in a seed round from Mark Suster, Alexis Ohanian, First Round, Lowercase Capital, SV Angel, Mucker Capital, Launchpad, and others.

Vidme, a video sharing application, raised $3.2 million in a seed round from Mark Suster, Alexis Ohanian, First Round, Lowercase Capital, SV Angel, Mucker Capital, Launchpad, and others.

Early stage

![]() Joya Communications, a mobile video communications company, raised $5 million in a Series A round led by Battery Ventures and Altos Ventures.

Joya Communications, a mobile video communications company, raised $5 million in a Series A round led by Battery Ventures and Altos Ventures.

![]() RealtyShares, a crowdfunding platform for real estate, raised a $10 million Series A round led by Menlo Ventures with participation from General Catalyst Partners.

RealtyShares, a crowdfunding platform for real estate, raised a $10 million Series A round led by Menlo Ventures with participation from General Catalyst Partners.

![]() Healthcare consulting company Accreon raised a $5.5 million round of funding from Mansa Capital.

Healthcare consulting company Accreon raised a $5.5 million round of funding from Mansa Capital.

![]() Rubicon Labs, a cybersecurity firm developing secure communication technologies for the IoT market, raised $11 million from Akamai Technologies, Third Point Ventures and Pelion Ventures.

Rubicon Labs, a cybersecurity firm developing secure communication technologies for the IoT market, raised $11 million from Akamai Technologies, Third Point Ventures and Pelion Ventures.

![]() DealStruck which specializes in securing loans for small businesses, raised $8.3 million funding round from undisclosed investors, and a $50 million credit facility.

DealStruck which specializes in securing loans for small businesses, raised $8.3 million funding round from undisclosed investors, and a $50 million credit facility.

![]() EBR Systems, developer of a wireless cardiac pacing system for heart failure, raised $20 million in a round led by Emergent Medical Partners, along with Split Rock Partners, SV Life Sciences, Delphi Ventures, St. Paul Venture Capital, a cardiovascular corporate strategic investor and private investors including Dr. Fogarty and Stephen Mahle.

EBR Systems, developer of a wireless cardiac pacing system for heart failure, raised $20 million in a round led by Emergent Medical Partners, along with Split Rock Partners, SV Life Sciences, Delphi Ventures, St. Paul Venture Capital, a cardiovascular corporate strategic investor and private investors including Dr. Fogarty and Stephen Mahle.

![]() Patch of Land, a crowdfunding solution for real estate financing, raised $23.6 million in a round led by SF Capital Group, with Ron Suber participating.

Patch of Land, a crowdfunding solution for real estate financing, raised $23.6 million in a round led by SF Capital Group, with Ron Suber participating.

![]() AssetAvenue, an online platform for commercial real estate loans, raised $11 million in a Series A funding round led by DCM Ventures, along with NetEase and Matrix Partners.

AssetAvenue, an online platform for commercial real estate loans, raised $11 million in a Series A funding round led by DCM Ventures, along with NetEase and Matrix Partners.

![]() NSONE, a high performance DNS service, raised $5.35 million in a round led by Flybridge Capital Partners and Sigma Prime Ventures, with participation from Founder Collective, Center Electric, and others.

NSONE, a high performance DNS service, raised $5.35 million in a round led by Flybridge Capital Partners and Sigma Prime Ventures, with participation from Founder Collective, Center Electric, and others.

![]() Opendorse, which connects marketers with athletes to build endorsement campaigns, raised $1.75 million in a Series A round led by Flyover Capital, with participation from various angel investors.

Opendorse, which connects marketers with athletes to build endorsement campaigns, raised $1.75 million in a Series A round led by Flyover Capital, with participation from various angel investors.

![]() D3O, an impact protection solutions company, raised £13 million in funding from Entrepreneurs Fund and Beringea.

D3O, an impact protection solutions company, raised £13 million in funding from Entrepreneurs Fund and Beringea.

![]() Custora, a marketing software startup, raised a $6.5 million Series A round led by Foundation Capital with participation from Greycroft Partners and Valhalla Ventures.

Custora, a marketing software startup, raised a $6.5 million Series A round led by Foundation Capital with participation from Greycroft Partners and Valhalla Ventures.

![]() Linux distribution company CoreOS raised $12 million in a round led by Google Ventures with participation by Kleiner Perkins Caufield & Byers, Fuel Capital and Accel Partners.

Linux distribution company CoreOS raised $12 million in a round led by Google Ventures with participation by Kleiner Perkins Caufield & Byers, Fuel Capital and Accel Partners.

![]() Content publishing platform RebelMouse raised $6 million from Softbank Capital and Oak Investment Partners, with participation from Mike Lazerow.

Content publishing platform RebelMouse raised $6 million from Softbank Capital and Oak Investment Partners, with participation from Mike Lazerow.

![]() 3D printing technology company Carbon3D raised a $10 million funding round from Autodesk.

3D printing technology company Carbon3D raised a $10 million funding round from Autodesk.

![]() Alzheon, a clinical-stage biopharmaceutical company, raised a $10 million Series A round led by Ally Bridge Group and other new and existing investors.

Alzheon, a clinical-stage biopharmaceutical company, raised a $10 million Series A round led by Ally Bridge Group and other new and existing investors.

![]() Vulcun, a tournament site for fantasy e-sports, raised $12 million from Sequoia Capital and other investors.

Vulcun, a tournament site for fantasy e-sports, raised $12 million from Sequoia Capital and other investors.

![]() This Game Studio, a mobile game developer, raised a $5 million round of funding from NCSoft.

This Game Studio, a mobile game developer, raised a $5 million round of funding from NCSoft.

![]() TriPlay, a personal cloud company, raised $11 million from funds managed by affiliates of Fortress Investment Group, along with Kenges Rakishev and Tamir Koch.

TriPlay, a personal cloud company, raised $11 million from funds managed by affiliates of Fortress Investment Group, along with Kenges Rakishev and Tamir Koch.

![]() Soha Systems, a cloud-based security service, raised $9.8 million in funding from Andreesen-Horowitz, Cervin Ventures, Menlo Ventures and Moment Ventures.

Soha Systems, a cloud-based security service, raised $9.8 million in funding from Andreesen-Horowitz, Cervin Ventures, Menlo Ventures and Moment Ventures.

![]() Zebra Medical Vision, a medical imaging research platform, raised $8 million in a ound led by Khosla Ventures, with participation from DeepFork Capital and Marc Benioff.

Zebra Medical Vision, a medical imaging research platform, raised $8 million in a ound led by Khosla Ventures, with participation from DeepFork Capital and Marc Benioff.

Late stage

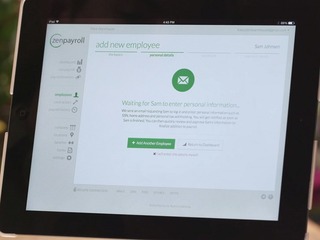

![]() Payroll processing service ZenPayroll raised $60 million in a round led by Google Capital, with participation from Emergence Capital Partners, Ribbit Capital, General Catalyst, Kleiner Perkins Caufield & Byers, Google Ventures and others.

Payroll processing service ZenPayroll raised $60 million in a round led by Google Capital, with participation from Emergence Capital Partners, Ribbit Capital, General Catalyst, Kleiner Perkins Caufield & Byers, Google Ventures and others.

![]() RedSeal, developer of security risk management software and solutions, raised a $17 million round of funding from Tyco, MATH Venture Partners, Pallasite Ventures, DRW, Venrock, Sutter Hill, Icon Ventures, Leapfrog, Olympic Ventures and others.

RedSeal, developer of security risk management software and solutions, raised a $17 million round of funding from Tyco, MATH Venture Partners, Pallasite Ventures, DRW, Venrock, Sutter Hill, Icon Ventures, Leapfrog, Olympic Ventures and others.

![]() Global Fashion Group, a fashion e-commerce group, raised €32 million funding round from Tengelmann Ventures and Verlinvest.

Global Fashion Group, a fashion e-commerce group, raised €32 million funding round from Tengelmann Ventures and Verlinvest.

![]() Indian payments startup MobiKwik raised $25 million in a round led by Tree Line Asia, with Cisco, Sequoia Capital and American Express participating.

Indian payments startup MobiKwik raised $25 million in a round led by Tree Line Asia, with Cisco, Sequoia Capital and American Express participating.

image: https://vni.s3.amazonaws.com/150204191008240.png

![]() FirstCry.com, an e-commerce site for babies and kids, raised $10 million from New Enterprise Associates, with participation from Valiant Capital.

FirstCry.com, an e-commerce site for babies and kids, raised $10 million from New Enterprise Associates, with participation from Valiant Capital.

![]() Palerra, a cloud security automation company, raised a $17 million round led by August Capital, with participation from Norwest Venture Partners, Wing Venture Capital and Engineering Capital.

Palerra, a cloud security automation company, raised a $17 million round led by August Capital, with participation from Norwest Venture Partners, Wing Venture Capital and Engineering Capital.

![]() Business management platform Domo raised $200 million in a funding round led by Blackrock, with Capital Group, Glynn Capital Management and GGV Capital participating.

Business management platform Domo raised $200 million in a funding round led by Blackrock, with Capital Group, Glynn Capital Management and GGV Capital participating.

![]() Via, an on-demand transit company, raised a $27 million Series B round led by Pitango Venture Capital, with participation from Hearst Ventures, Ervington Investments, and 83North.

Via, an on-demand transit company, raised a $27 million Series B round led by Pitango Venture Capital, with participation from Hearst Ventures, Ervington Investments, and 83North.

![]() CliQr, a hybrid cloud migration and management company, raised $20 million in Series C funding led by Polaris Partners with participation from Foundation Capital, Google Ventures and TransLink Capital.

CliQr, a hybrid cloud migration and management company, raised $20 million in Series C funding led by Polaris Partners with participation from Foundation Capital, Google Ventures and TransLink Capital.

![]() Sharecare, a digital health and wellness engagement platform, raised a $20 million round from Wellington Management Company LLP.

Sharecare, a digital health and wellness engagement platform, raised a $20 million round from Wellington Management Company LLP.

![]() FirstFuel Software, a customer intelligence service for energy providers, raised $23 million in a round led by Next World Capital, along with Electranova Capital, Battery Ventures, Rockport Capital, Nth Power and E.ON SE.

FirstFuel Software, a customer intelligence service for energy providers, raised $23 million in a round led by Next World Capital, along with Electranova Capital, Battery Ventures, Rockport Capital, Nth Power and E.ON SE.

![]() Temando, a fulfillment software platform for eCommerce, raised a $50 million Series B round from Neopost S.A.

Temando, a fulfillment software platform for eCommerce, raised a $50 million Series B round from Neopost S.A.

![]() Pixability, a video ad buying and marketing technology company, raised an $18 million Series C financing round led by Jump Capital and Edison Partners, along with all existing investors, including Point Judith Capital and Quad Graphics.

Pixability, a video ad buying and marketing technology company, raised an $18 million Series C financing round led by Jump Capital and Edison Partners, along with all existing investors, including Point Judith Capital and Quad Graphics.

IIX Inc. a software-defined interconnection company, raised $20 million in funding from TriplePoint Capital,

IIX Inc. a software-defined interconnection company, raised $20 million in funding from TriplePoint Capital,

![]() Kyriba, a cloud-based treasury management solution, raised a $21 million round of Series C funding from HSBC, BRED Banque Populaire, Daher Capital, Iris Capital and Upfront Ventures.

Kyriba, a cloud-based treasury management solution, raised a $21 million round of Series C funding from HSBC, BRED Banque Populaire, Daher Capital, Iris Capital and Upfront Ventures.

![]() Quikr, an Indian classified ads site, raised $150 million from Tiger Global, Investment AB Kinnevik and Steadview Capital.

Quikr, an Indian classified ads site, raised $150 million from Tiger Global, Investment AB Kinnevik and Steadview Capital.

![]() Mojix, a provider of wide area sensor networks, raised a $14 million Series D financing round led by OMERS Ventures, with Mercury Ventures and all previous investors also participating.

Mojix, a provider of wide area sensor networks, raised a $14 million Series D financing round led by OMERS Ventures, with Mercury Ventures and all previous investors also participating.

![]() Marijuana venture capital firm Privateer Holdings raised a $75 million round from Founders Fund.

Marijuana venture capital firm Privateer Holdings raised a $75 million round from Founders Fund.

![]() Natera, a non-invasive genetic testing company, raised approximately $55.5 million in funding led by Sofinnova Ventures, with participation from Capital Research and Management, Franklin Templeton Investments, Jennison Associates, RA Capital Management, Healthcor Partners and OrbiMed Advisors.

Natera, a non-invasive genetic testing company, raised approximately $55.5 million in funding led by Sofinnova Ventures, with participation from Capital Research and Management, Franklin Templeton Investments, Jennison Associates, RA Capital Management, Healthcor Partners and OrbiMed Advisors.

![]() Clypd, a sell-side technology provider, raised $19.4 million in a Series B round led by RTL Group, with participation from Atlas Venture, Data Point Capital, Duke University, TiVo Inc., Transmedia Capital and Western Technology Investment.

Clypd, a sell-side technology provider, raised $19.4 million in a Series B round led by RTL Group, with participation from Atlas Venture, Data Point Capital, Duke University, TiVo Inc., Transmedia Capital and Western Technology Investment.

![]() On-demand cab service giant Ola raised $315 million from DST Global, Tiger Global, Steadview Capital and Accel Partners.

On-demand cab service giant Ola raised $315 million from DST Global, Tiger Global, Steadview Capital and Accel Partners.

![]() Prosper Marketplace, an online marketplace for credit, raised a $165 million Series D round led by Credit Suisse NEXT Investors, along with J.P. Morgan Asset Management, SunTrust Banks, BBVA Ventures, Neuberger Berman Private Equity Funds, Passport Capital, Breyer Capital, and others.

Prosper Marketplace, an online marketplace for credit, raised a $165 million Series D round led by Credit Suisse NEXT Investors, along with J.P. Morgan Asset Management, SunTrust Banks, BBVA Ventures, Neuberger Berman Private Equity Funds, Passport Capital, Breyer Capital, and others.

![]() Urban Ladder, an Indian e-commerce store, raised $50 million in a round led by Sequoia Capital and TR Capital, with Steadview Capital, SAIF Partners, and Kalaari Capital.

Urban Ladder, an Indian e-commerce store, raised $50 million in a round led by Sequoia Capital and TR Capital, with Steadview Capital, SAIF Partners, and Kalaari Capital.

![]() Estimize.com, which uses crowdsourcing to produce a set of earnings estimates, raised a $3 million Series B round led by WorldQuant Ventures, along with both new and existing investors.

Estimize.com, which uses crowdsourcing to produce a set of earnings estimates, raised a $3 million Series B round led by WorldQuant Ventures, along with both new and existing investors.

![]() The RealReal, an authenticated luxury consignment company, raised $40 million in Series D funding led by Industry Ventures, with e.ventures Growth, Greycroft Growth, DBL Partners, Canaan Partners and InterWest Partners participating.

The RealReal, an authenticated luxury consignment company, raised $40 million in Series D funding led by Industry Ventures, with e.ventures Growth, Greycroft Growth, DBL Partners, Canaan Partners and InterWest Partners participating.

![]() Aviso, a predictive insights software company for sales management, raised a $15 million round of Series B funding co-led by Scale Venture Partners and Next World Capital, with participation from all existing angels and investors, including Shasta Ventures, First Round Capital, Bloomberg Beta and Cowboy Ventures.

Aviso, a predictive insights software company for sales management, raised a $15 million round of Series B funding co-led by Scale Venture Partners and Next World Capital, with participation from all existing angels and investors, including Shasta Ventures, First Round Capital, Bloomberg Beta and Cowboy Ventures.

![]() Niara, a stealth security analytics company, raised a $20 million Series B round led by Venrock, with additional participants including New Enterprise Associates (NEA) and Index Ventures.

Niara, a stealth security analytics company, raised a $20 million Series B round led by Venrock, with additional participants including New Enterprise Associates (NEA) and Index Ventures.

![]() Timeshare marketplace Vacatia raised $7 million in a funding round led by Javelin Venture Partners.

Timeshare marketplace Vacatia raised $7 million in a funding round led by Javelin Venture Partners.

![]() FreeAgent, a cloud accounting provider for micro-businesses and retailers, raised $5 million in funding. from SaaS Capital.

FreeAgent, a cloud accounting provider for micro-businesses and retailers, raised $5 million in funding. from SaaS Capital.

Doctor On Demand, Softbank, Namely, Mezaaj, Are You A Human, Framebridge, Spacious, MentAd, GoFundMe

Read more...Duolingo, Vinli, Jimdo, Dalia Research, Procore Technologies, Colabo, Menlo Security, Enervee, Tile

Read more...DocuSig, Flywheel, Enervee, Notion, VitalFields, jobandtalent, EverCompliant, Tegile Systems, Ubimo

Read more...Startup/Business

Joined Vator on

Founded on October 7, 2010 and based in Atlanta, GA, Sharecare's mission is to greatly simplify the search for high-quality healthcare information and answer the world’s questions of health. Created by Jeff Arnold and Dr. Mehmet Oz, in partnership with Harpo Studios, HSW International, Sony Pictures Television, and Discovery Communications, the Sharecare interactive social Q & A platform allows people to ask, learn and act upon questions of health and wellness. The company's innovative approach provides a wide array of expert answers to each question ranging from hospitals to MDs to non-profits to healthcare companies to active health consumers, ultimately creating a community where healthcare knowledge is built, shared and put into practice.

Startup/Business

Joined Vator on

Slidejoy is an intelligent Android application that pays users to view relevant articles, deals and ads on their lock screen. Since Slidejoy shares its advertising revenues, our app essentially allows you to monetize an otherwise idle asset by turning your smart phone lockscreen into an interactive and personalized billboard.

Our users obtain a real tangible benefit - money - for doing something they constantly already do: unlocking their smartphones. Users don't even have to engage with our ads, they get paid the same amount regardless of whether they open or disregard the ads.

Startup/Business

Joined Vator on

Founded by husband-and-wife team Michal and Vlada Bortnik in 2012, Joya is focused on helping people remain connected in convenient, meaningful and fun ways. The company’s first app, Joya Video, was one of TIME Magazine’s Top 50 Apps for 2013. The two latest apps, Cleo and FlipLip, were selected to be a part of Facebook’s new Messenger launch in March 2015.

Startup/Business

Joined Vator on

RealtyShares is an online investment platform that uses crowdfunding to pool investors into private real estate investments. Accredited Investor members can browse a variety of investment opportunities, review details on the investment and invest as little as $1,000. Execution of investor documents and fund transfers are handled securely through our platform, allowing investors to complete the entire transaction process through our site.

RealtyShares targets both residential and commercial investment opportunities. Today we offer both fixed-income investments in the form of first-position loans secured by 1-4 unit residential properties usually yielding between 8-10% as well as equity investments in apartments, retail and office properties. Each investment property is professionally operated and managed by a dedicated Real Estate Company making the investment completely passive to investors.

Startup/Business

Joined Vator on

Money and lending is typically controlled by large institutions. Prosper wants to change that.Startup/Business

Joined Vator on

clypd is the advertising technology platform built exclusively for the television industry, empowering media owners with programmatic ad solutions. Founded in 2012, the company's TV sales platform delivers workflow automation, data-enhanced decisioning and provides media partners with tools to manage their sales efforts. clypd's innovations around programmatic television is opening doors for incremental digital budgets currently not available to the TV media owners. The clypd team is comprised of both TV and digital advertising experts, which uniquely positions the company to understand and meet the needs of the television industry while leveraging the best programmatic strategies from the digital world.