Forum Ventures report: where health systems say innovation is most needed

The report outlined four areas as a guide to help startups to sell into these systems

Read more...

This year in news: The New York Times fired its first female Editor-in-Chief, Jill Abramson. Because bitches, man!

We still don’t really know why Abramson was fired. Reports have claimed that she was fired, in part, because she confronted her higher-ups over the fact that her total compensation package was smaller than that of her predecessor. There have also been reports that the executive staff had a hard time with her “brusque” personality—which actually does translate to “bitches, man.”

The whole snafu has brought up an interesting issue which, even as an avowed (one might say “rabid”) feminist, even I had never heard of: the Glass Cliff. The theory, coined by psychology professors Michelle Ryan and Alex Haslam of Exeter University in 2004, holds that once women and minorities break through the “glass ceiling,” they find themselves in very precarious positions of power because they’re usually chosen to run organizations or units that are already in decline. Thus, they’re likely to fail and be fired.

Utah State University sociology professor Christy Glass and her colleague, Allison Cook, studied sports and Fortune 500 companies to find evidence of this, and what they found is that minority coaches are much more likely to be promoted to losing teams, and women and minorities are much more likely to be promoted to CEO of struggling or failing companies.

This is not to say that they’re intentionally sabotaged—no Board is going to promote a CEO that it thinks will fail. A more likely explanation is that these are the positions that more in-demand white male CEOs are unwilling to take, and thus women and minorities are the only ones willing to give it a go.

So what about Silicon Valley? Are signs of the Glass Cliff visible in the tech world?

Marissa Mayer

The first and most obvious example that comes to mind is Marissa Mayer. Mayer was not only a female CEO pick, but the first pregnant CEO of a Fortune 500 company in history. This is important because while the pay gap between men and women is closing, the pay gap between mothers, non-mothers and fathers is actually growing. While childless women earn about 90 cents to every dollar earned by their male counterparts, mothers earn 73 cents, and single mothers earn 56 cents. If women are considered Plan B to the more desirable male CEOs, mothers are considered the bottom of the barrel.

Mayer was appointed CEO in July 2012, following four straight years of revenue decline. And 2013 wasn’t much better, declining another 1% from 2012. There are some signs that things are improving: traffic is up—Yahoo actually beat Google in traffic for the first time since 2011 last August, with 196.6 million unique visitors in the month of July. And in the first quarter of 2014, mobile users were up 30% to 430 million. Even display ads—Yahoo’s chief moneymaker—saw a modest climb of 1% in revenue in the first quarter. But while demand for display ads was up 7%, the cost of those ads continued to fall, dropping 5% year-over-year.

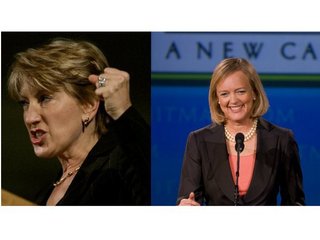

Carol Bartz

Mayer’s predecessor, Carol Bartz, is another example of the Glass Cliff. Bartz was brought on in 2009 when the company had already gone through three other CEOs in eight years—Tim Koogel, former Hollywood executive Terry Semel, and Yahoo co-founder Jerry Yang. By the time Bartz took over, shares were down some 69% from June 2007, when Yang took the helm. They were down a full 98% from the stock’s all time high of $475 in January 2000.

Under Bartz, the company continued to flounder as talent fled to Google and Facebook, and she was canned two and a half years later.

Meg Whitman

Another Glass Cliff example: Meg Whitman. Whitman was brought on board HP as CEO in 2011—right when PC sales began to drop. PC sales have been on the decline since 2010, when the iPad first burst onto the scene. 2013 saw one of the worst declines in PC sales in history, and they dropped an additional 6.9% in the fourth quarter of 2013 to 82.6 million units, marking the seventh consecutive quarter of shipment declines. That’s down from 88.7 million units shipped in the fourth quarter of 2012. Compare that to 92.2 million units in the fourth quarter of 2011.

So it’s no mystery why HP’s earnings have been in a free fall since Whitman took over. Revenue has declined 12.5% since 2011 while gross income has declined nearly 14%. As the leader of the PC market, HP has taken the biggest hit.

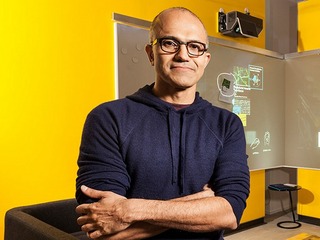

Satya Nadella

Speaking of PCs, let’s take a look at Microsoft. After 13 years as CEO, Steve Ballmer stepped down in late 2013. He was replaced by Satya Nadella, an Indian-born engineer and business executive. You might be thinking: Asians are not minorities in Silicon Valley. Yes and no. While there is a thriving Asian population in the tech industry, there are only nine Asian CEOs of Fortune 500 companies, which translates to 1.8% of all Fortune 500 companies.

Microsoft isn’t necessarily failing—sales and profits have been going strong for the last few years. But the company—once the dominant player in the tech industry—has been struggling to transition to the new mobile landscape. Windows 8 has not been doing so hot, and the newly released Surface has been widely panned.

Microsoft’s mobile market share stands at a puny 3.3%, as of May 2014—which is actually up from 3.1% in December 2013, according to comScore. That’s compared to Google at 52.2% and Apple at 41.4%. As of 2013, revenue generated by iPhone sales alone was greater than Microsoft’s overall revenue.

And while the Surface was meant to be Microsoft’s foray into the tablet market, sales have been dismal. The company generated $893 million in Surface sales in the fourth quarter of 2013 (the holiday quarter), while Apple sold nearly $11.5 billion in iPads for the same quarter. To be fair, Surface sales were up 123% from the $400 million it generated in the three months ending in September 2013, but iPad sales were also up 85% year-over-year.

Marissa Mayer, Carol Bartz, Meg Whitman, and Satya Nadella—what they all have in common is that they’re outliers in the Fortune 500 CEO world, and they were all brought on to lead floundering companies (some more than others). While women and minorities continue to struggle to be taken seriously or even considered for employment in Silicon Valley startups, they can at least rest assured that they’ll be tossed a bone when those startups get really big, crest, and then fall into a death spiral.

Image source: bwbx.io

The report outlined four areas as a guide to help startups to sell into these systems

Read more...Flyte delivers mechanotherapy transvaginally to the pelvic floor

Read more...The country will need an additional 203,200 RNs each year until 2031 to fill staffing shortages

Read more...