M&A activity in the warehouse robotic space

Robots are taking over the heavy lifting work inside warehouses

Read more...

Everyone wants in on the mobile payment and electronic wallet market. First is was Square, then PayPal, then LevelUP, and now the app that got started by letting people share business card info with the "bump" of their phones is rethinking how you can exchange payments.

Bump released a new application called Bump Pay that lets friends and businesses exchange funds with by tapping their devices together.

The iOS app allows users to transfer money via PayPal to anyone in arm’s reach.

So no more need to write your friends a check or scramble to look for cash when splitting the bill at a restaurant, just bump phones and its all even. It seems simple enough that even tech luddites could figure that one out. But there are a few disadvantages to this method. One, you have to all have iPhones -- not a big issue is San Francisco, but definitely a factor elsewhere. And, you also have to be in arms reach of the person -- so no pinging a friend the payment you owe them when they are at their office and you are at yours.

This is just the latest development out go the Bump Labs, Bump‘s experimental wing of app inventions. The company is currently releasing this app as a separate entity from their business card and info sharing app that has been installed 84 million times, to see if the idea gains traction.

For tapping payments, all you have to do is connect your PayPal account ahead of time, then enter the amount you want to pay, bump your iOS device against a friend’s, and confirm the payment. Bonus -- as long you use a checking account connected to your PayPal, there’s no fee for the transfer. If you use a credit card in your PayPal account there is a fee, much like PayPal's mobile wallet and Square's mobile payment systems.

The four-year-old company with around $20 million in funding, has tried to incorporate more services in its app since 2010, but often drops them to stick with simplicity. In fact, Bump was one of the first companies PayPal looked to for its API but dropped that functionality in favor of opening a window on mobile devices.

Another advantage of this app is that Bump Pay allows users modify how secure they want the app to be. They can choose to enter their PayPal password once and have the app remember it, or they can choose to enter their password every time.

For now, the service only works with PayPal, but the company may explore more payment services to incorporate and will consider adding tools that could help people split bills, add tip and other things that would be handy to keep in app.

The competition

Just two weeks ago, PayPal unveiled the design of its triangular dongle, which will process mobile payments for small businesses internationally.

The dongle is called PayPal Here and fans out to avoid stress on the audio jack when merchants run credit cards through the system. The complimentary app that connects with the device is similarly designed to the Square app with some of the same features that were recently updated when Square started zoning in on the entire POS process (so that it can account for cash and check payments as well as have designated buttons for item prices).

The PayPal Here allows small business owners to show the customer the total, as well as allow customers easy tip-of-the-finger signing.

One feature that is interesting is the ability to scan cards if the dongle is lost or damaged. A merchant can scan the card (or checks) to secure payment. A great way to assure no revenue is lost.

Until now, PayPal has been a leader in the secure online payment market and has only recently set its sights on retail locations such as Home Depot. Square, on the other hand, has jumped out as the leader in mobile payments since its inception in 2010. Square has already processing $4 billion in transactions each year, take 2.75 percent for transaction fees.

When you sign up to be a part of the PayPal Here system, you will receive a PayPal debit card -- which is central in capturing the lower transaction fees. This card results in a 1% return for purchases made using the card. With that one percent back, PayPal says its transaction fee will be 1.7 percent (which is 1.05% less than Square, but for customers that don't use the PayPal debit card, the transaction fee is virtually identical).

The PayPal app, called “local,” is a customer loyalty app that helps merchants recognize frequent customers and offer service assistance and deals.

PayPal already has 17 million users using its mobile application, but the loyalty and nubile points go to the young and innovative Square, which has already struck a cord with one-fifth of the credit-card accepting merchants in the US.

This week, Square also added a few updates to its payment services -- including an upgraded Android app and the launch of a service called "Pay with Square."

The San Francisco digital payment company known for its square-shaped dongle that fits into the audio-jack of mobile devices has updated its website with some shiny new features that are helping bring the company even deeper into the mobile payment space.

Now, Android users can now make hands-free payments with Pay With Square for the first time and the Pay with Square app is now allowing users Yelp-like features. These Yelp-y features offer users recommend merchants and allow you to suggest businesses you like to friends via SMS, Twitter or email.

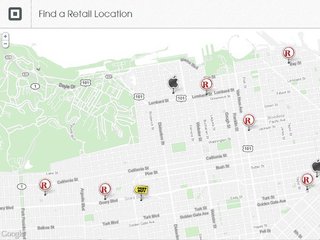

Square users can also now search and map businesses that accept Square so they can easily use their mobile payment and discover new favorite locations.

Also, the new Pay with Square app allows you hands and wallet free purchasing once you turn on the geo-locator. Before, one would have had to swipe their card through the business' dongle to process a transaction on the Square system, but now, your name and account will appear on the Square system once you walk in the door at a Square-enabled business and you can verbally complete the transaction and get an email confirmation right to your phone. No more fumbling for your wallet in that black hole of a bag.

This new app came on the heels of Square's strong push to enter the register market and do away with the conventional (and pricey POS devices).

Launched at the start of the month, the new Square Register was unveiled on Sunday evening to extend the credit features to now accept cash payments, lets merchants create list menu items, and tracks the history of customers' purchases.

Currently, nearly 75% of U.S. merchants are in the market for tablets and tablet apps to incorporate into their business and more than half of retailers are gearing up tp use a mobile POS device within a year to 18 months, compared with a slim 6% now.

The status quo POS systems are often cumbersome in size and pricing -- many cost in the thousands per year to install and maintain, while Square has the attractive price tag of $0 and just charges a percentage fee based on the number of transactions logged into the system.

It looks like the mobile payment world is getting a lot of attention now and it will get easier and easier to spend those hard earned dollars.

Robots are taking over the heavy lifting work inside warehouses

Read more...The company also expanded access to 12 different provider types for male fertility care

Read more...Ezra's AI cancer screening platform will be available in 150 RAYUS locations

Read more...